How Artificial Intelligence Is Influencing the Banking and Finance Sector

Vijaykumar Meti

Artificial Intelligence

April 5, 2022

6 min read

Artificial Intelligence (AI) has become an integral part of the most demanding and fast-paced industries and the banking sector is no exception. It’s no wonder that AI has quickly become one of the technical pillars on which the entire modern financial market is built. The introduction of service AI in banking apps and services has made the sector more customer-centric and technologically relevant.

Tech-savvy customers, exposed to advanced technologies in their day-to-day lives, expect banks to deliver seamless experiences. To meet these expectations, banks have expanded their industry landscape to retail, IT, and telecom to enable services like mobile banking, e-banking, and real-time money transfers. While these advancements have enabled customers to avail most of the banking services at their fingertips anytime, and anywhere.

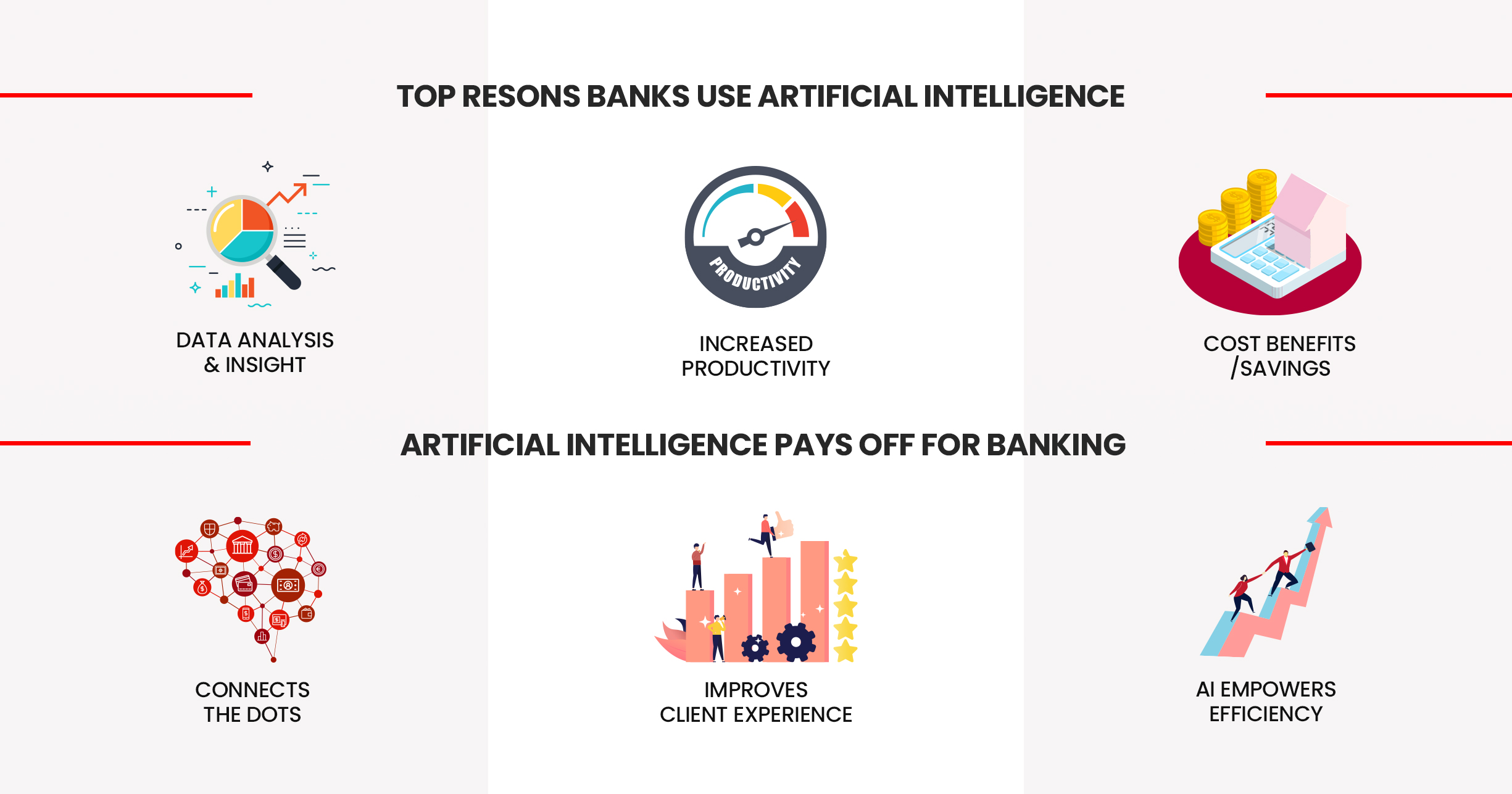

According to a survey of financial services professionals, 80 percent of banks are highly aware of the potential benefits presented by AI. Certain AI use cases have already gained prominence across banks’ operations, with chatbots in the front office and anti-payments fraud in the middle office the most mature.

Another report suggests that by 2023, banks are projected to save $447 billion by using AI mobile apps. These numbers indicate that the banking and finance sector is swiftly moving towards AI to improve efficiency, service, productivity, and RoI and reduce costs.

Banks can use AI to transform the customer experience by enabling frictionless, 24/7 customer interactions – but AI in banking applications isn’t just limited to retail banking services. The back and middle offices of investment banking and all other financial services for that matter could also benefit from AI.

Also Read: Top 10 Trends That Will Reshape The FinTech Landscape in 2022

Not everyone is aware that AI is not only a leading analytical solution but also a way to change the way customers interact with services provided by the financial industry. The impact of AI in the banking and financial sector has been phenomenal and it is completely redefining the way they function, create products and services, and how they transform the customer experience.

Let’s take a closer look at this extraordinary relationship, its impact on the way we use banks, and on issues such as fraud detection and compliance regulations.

Banking on Artificial Intelligence

AI technology brings the advantage of digitization to banks and helps them meet the competition posed by FinTech players. About 32% of financial service providers globally are already using AI technologies like Predictive Analytics, Voice Recognition, etc, according to joint research conducted by the National Business Research Institute and Narrative Science.

AI is the future of banking as it brings the power of advanced data analytics to combat fraudulent transactions and improve compliance. AI algorithms accomplish anti-money laundering activities in a few seconds, which otherwise take hours and days.

AI also enables banks to manage huge volumes of data at record speed to derive valuable insights from it. Features such as AI bots, digital payment advisers, and biometric fraud detection mechanisms lead to a higher quality of services to a wider customer base. All this translates to increased revenue, reduced costs, and a boost in profits.

How Exactly Is Artificial Intelligence Used In Banking?

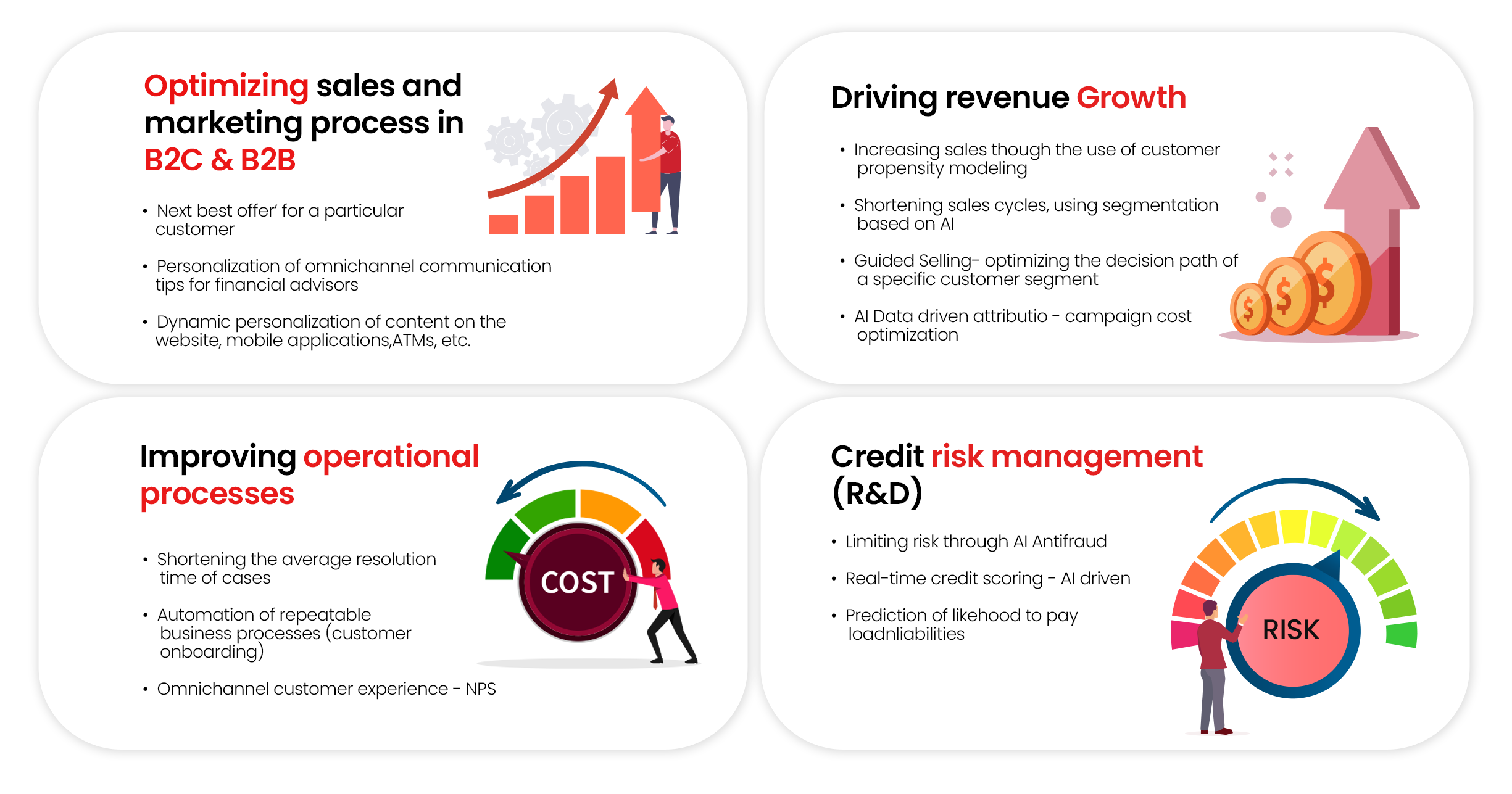

Artificial Intelligence benefits with advantages valued by managers responsible for financial institutions’ strategies – i.e. cost reduction, sales, revenue improvement, or business risk mitigation. However, it’s also worth mentioning that the AI options used by banks do not end there. The possibilities can go far behind typical expected features. The illustrations below explain how AI is used in finance and banking;

Applications of AI in Banking and Finance

AI technologies have become an integral part of the world we live in, and banks have started integrating these technologies into their products and services at scale to remain relevant. The rise and the impact of artificial intelligence in the banking and financial sector have been phenomenal and it is completely redefining the way banks work, create products and services, and how to transform the customer experience. Here are a few ways in which AI is transforming the banking industry.

Ramp Up Cybersecurity and Fraud Detection

Every day, an enormous amount of digital transactions take place as users withdraw money, deposit checks, pay bills, and do a lot more via apps or online accounts. Therefore, there is an increasing need for the banking and finance sector to ramp up its cybersecurity and fraud detection efforts.

This is when artificial intelligence in banking comes to play. AI can help banks improve the security of online finance, track the loopholes in their systems, and minimize risks. AI along with machine learning can easily identify fraudulent activities and alert customers as well as banks.

AI-Powered Chatbots

Chatbots are one of the best examples of practical applications of artificial intelligence in banking. Once implemented, they work 24×7, unlike humans who have fixed working hours. Furthermore, AI chatbots keep on learning about the usage pattern of a particular customer. It helps them understand the requirements of a user efficiently.

By integrating chatbots into banking apps, the banks can ensure that they are available for their customers round the clock. Moreover, by understanding customer behavior, chatbots can offer personalized customer support and recommend suitable financial services and products accordingly.

Data Collection and Analysis

Banking and finance service providers record millions of transactions every single day. Since the volume of information generated is huge, its collection and registration turn into an overwhelming task for employees. Structuring and recording such a huge amount of data without any error becomes impossible.

In such cases, AI-powered innovative solutions can help in data collection and analysis. This also improves the overall user experience. The information can also be used for detecting fraud or making credit decisions as well.

Also Read: Big Data in 2022: Revolutionizing the Core of Modern Business Landscape

Enhance Customer Experience

Customers are constantly looking for a better experience and convenience. For example, ATMs were a success because customers could avail essential services of withdrawing and depositing money even when banks were closed. This level of convenience has only inspired more innovation. Customers can now open bank accounts from the comfort of their homes using their smartphones.

Integrating artificial intelligence in banking and finance services will further enhance consumer experience and increase the level of convenience for users. AI technology reduces the time taken to record Know Your Customer (KYC) information and eliminates errors. Additionally, new products and financial offers can be released on time.

Risk Management

Global factors such as currency fluctuations, natural disasters, or political unrest have serious impacts on the banking and financial sector. During such unstable times, it’s crucial to take business decisions extra cautiously.

AI-driven analytics can give a reasonably clear picture of what is to come and help you stay prepared and make timely decisions.

AI also helps find risky applications by evaluating the probability of a client failing to pay back a loan. It predicts this future behavior by analyzing past behavioral patterns and smartphone data.

Predictive Analytics

AI can detect specific patterns and correlations in the data, which traditional technology could not previously detect. It is one of AI’s most common use cases including general-purpose semantic and natural language applications and broadly applied predictive analytics. These patterns could indicate untapped sales opportunities, cross-sell opportunities, or even metrics around operational data, leading to a direct revenue impact.

Process Automation

Robotic process automation (RPA) algorithms increase operational efficiency and accuracy and reduce costs by automating time-consuming repetitive tasks. This also allows users to focus on more complex processes requiring human involvement.

Regulatory Compliance

Banking is one of the highly regulated sectors of the economy worldwide. Governments use their regulatory authority to ensure that banking customers are not using banks to perpetrate financial crimes and that banks have acceptable risk profiles to avoid large-scale defaults.

Banks maintain an internal compliance team to deal with these problems, but these processes take a lot more time and require huge investment when done manually. AI uses deep learning and NLP to read new compliance requirements for financial institutions and improve their decision-making process. Even though AI banking can’t replace a compliance analyst, it can make its operations faster and more efficient.

Wrapping Up

Artificial intelligence will not only empower banks by automating their knowledge workforce, but it will also make the whole process of automation intelligent enough to do away with cyber risks and competition from FinTech players.

AI integration into the bank’s processes and operations keeps evolving and innovating with time without considerable manual intervention. It will enable banks to leverage human and machine capabilities optimally to drive operational and cost efficiencies, and deliver personalized services for customers.

AI-Driven Future

All of these benefits are no longer a futuristic vision to accomplish for banks. By adopting AI, key players in the banking sector have already taken action with due diligence to reap these benefits. AI will allow us not only to save time and money but also to better protect savings and more easily access our money.

Explore More Blogs

Testimonials What customers have to talk about us

Finch (previously Trio) – Growth with Investing, with benefits of Checking

Reading Time: < 1 minThe Finch (previously Trio), one of our clients today has reached this level with our expertise and with a great team of developers in Day One, who have made every stone unturned in making this project a big success.

Neel Ganu Founder

USA

Vere360 – VR based Immersive Learning

Reading Time: < 1 minDay One helped Vere360 “fill skill gaps” and build a platform that would cater to their niche and diverse audience while seamlessly integrate the best of #AI and #VR technology.

Ms. Adila Sayyed Co-Founder

Singapore

1TAM – Video Blogging Reimagined

Reading Time: < 1 min‘1TAM’ was only for iOS with gesture-based controls, advanced video compression techniques, and a simple architecture that allowed actions to be completed in 2-3 taps. The real challenge for ‘1TAM’ was to keep it distinct which bought brilliant results with all the strategies and approaches implied for best video compression techniques.

Anwar Nusseibeh Founder

UAE

Fit For Work – The Science of Workplace Ergonomics

Reading Time: < 1 minDay One Technologies came with the expertise that was required and helped in building a platform that is edgy, functional, and smart, delivering engagement and conversions at every step.

Ms. Georgina Hannigan Founder

Singapore

SOS Method Meditation for ‘Busy Minds’

Reading Time: < 1 minDay One Technologies helped in building an innovative mobile app (for #iOS and #Android) that’s easy-to-use, engaging, and data-driven to help users reap the most at every point.