How FinTech Startups Make Money in 2022: A Business Model Overview

Vijaykumar Meti

FinTech

July 19, 2022

11 min read

Are you a startup founder, investor, project manager, or serial entrepreneur looking for the best FinTech business model for your concept? Do you require a simple guide that explains the ideal FinTech business model?

If you responded yes to at least one of those questions, continue reading to learn:

- What is FinTech?

- FinTech business model definition.

- Types of FinTech business models.

- Excellent FinTech business concepts.

- And there’s more!

Let’s get into more specifics about this subject.

You may not know it, but the financial industry is experiencing one of the most significant changes in recent memory. Only a little more than a decade ago, cash accounted for more than half of all purchases. Today, that figure is less than 20%.

FinTech is not a new concept or technology; it has existed for a long time and has merely evolved at a quick rate. Whether it was the introduction of credit cards or ATMs, electronic trading floors, or high-frequency trading, technology has always been a component of the financial sector.

This is mostly due to the innovations in the FinTech industry. After the 2008 financial crisis, trust in traditional financial institutions was at an all-time low. This cleared the way for a new generation of enterprises that centered their operations on technology.

The year 2020 provided a stunning increase for the FinTech area, whether it was due to the effect of drastically lowering investment markets or an event of American corporations using the underlying FinTech business potential. This has resulted in investors’ interest being drawn to several FinTech industries.

Related: Why what you think of FinTech could be all wrong! Debunking Myths in FinTech

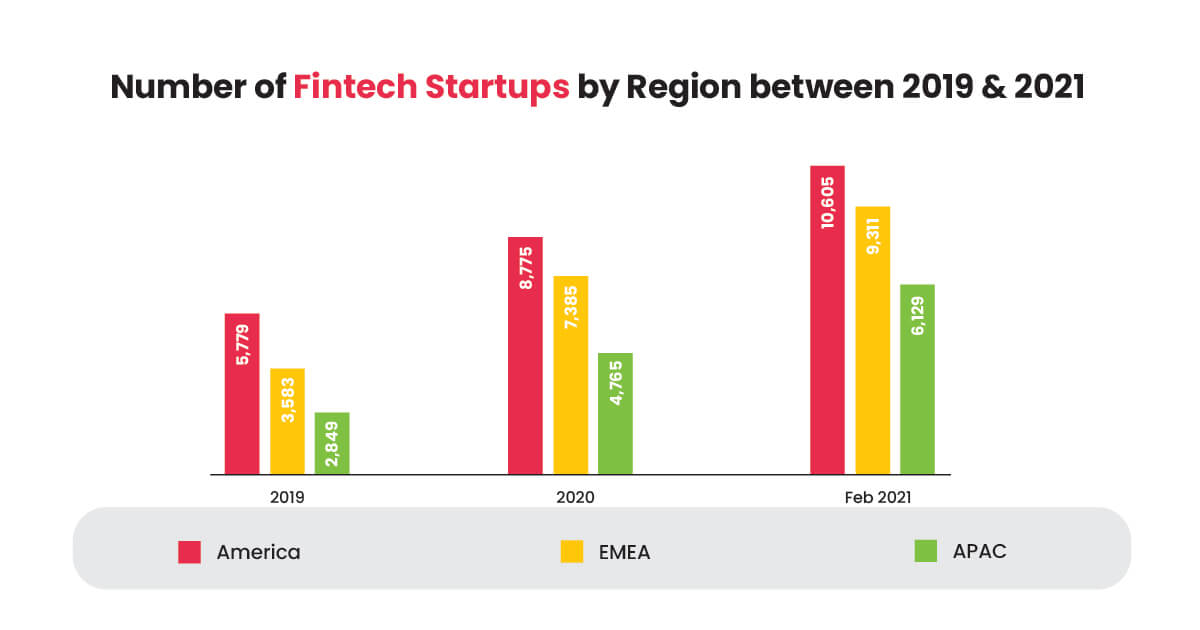

In particular, the US FinTech market will welcome around 8,775 FinTech companies in 2021, raising the worldwide FinTech adoption rate to 64%. Furthermore, the US FinTech industry has attracted investments totaling about $50 billion.

A few market studies predict that the worldwide financial services industry will reach $158,01 billion by 2023. According to Statista, the global number of financial services for startups has surpassed 6.5 thousand. FinTech software development firms have also seen the biggest number of start-ups funded globally, with less than three thousand.

These investments have definitely triggered a flurry of exciting events within the global FinTech market, and for all the right reasons. FinTech business models are growing faster than ever.

FinTech companies are here to stay, and their prominence is only escalating. This blog will dig a little deeper into what FinTech truly means, how it came to be, which businesses dominate the market, and its merits and downsides.

What is FinTech?

The term “FinTech” is a combination of two words: “financial” and “technology.”

FinTech is the idea of integrating a financial-related concept with technology to educate and/or empower consumers to access numerous financial possibilities that can add value to their lives.

The FinTech business has witnessed massive growth across many sectors during the last few years. Potential use cases have grown dramatically in recent years, owing mostly to the widespread adoption of smartphones as well as advances in processing power and networking infrastructure.

A multitude of FinTech business strategies enables their consumers to easily conduct monetary transactions between bank accounts. Some FinTech startup concepts attempt to bring investment-oriented financial services to customers through their smartphones. Then there are banking business models that allow consumers to handle their funds on the move while also utilizing APIs.

Most FinTech solutions are typically delivered through the development of algorithms, cloud computing, and software. FinTech solutions can be targeted at both individual customers (e.g., neobanks) and established (financial) enterprises, ranging from banks to insurance companies to typical businesses such as cafés or apparel stores.

Related: Top 10 Trends That Will Reshape The FinTech Landscape in 2022

FinTech firms have become a vital part of our daily lives, whether it’s paying your friend pal using Venmo or purchasing insurance through Lemonade. Furthermore, a rapid rise of conventional financial institutions has opted to collaborate with newly formed technological solutions.

Here are a few use cases among other business model examples:

- Digital banking

- Alternative credit scoring

- Unbundling

- Demographic-focused products

- Different fee structures

- Insurtech

The majority of today’s financial service company concepts benefit users in some way. However, someone who plans to become a participant in the FinTech business may opt to obtain more in-depth information on the field, which can be found in the following sections.

What is a FinTech Business Model?

A FinTech business model is a business plan for a financial technology company that comprises an operational strategy, income sources, and target client base.

FinTech firms often take an inclusive approach to finance, allowing customers convenient access to a diverse variety of financial services and products. Furthermore, these services and goods are accessible via mobile devices and do not have a time-consuming sign-up process. So, what factors influence a good business model?

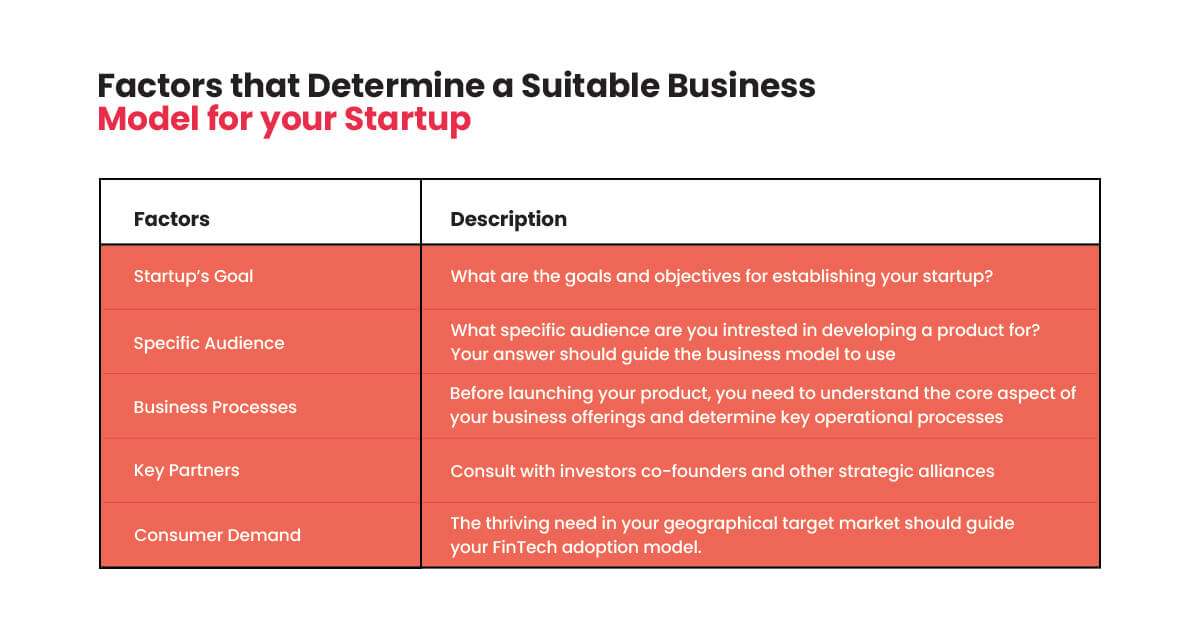

Factors to Consider When Choosing a Business Model for Your Startup

Before deciding on a FinTech operating model to complement your startup’s goals, it’s critical to consider the following criteria. Following that, you should choose a company plan that is compatible with them.

Now that you understand what a business model is and the variables to examine before adopting one.

Let’s go into the specifics of the most prevalent FinTech business concepts.

5 Most Popular FinTech Business Models

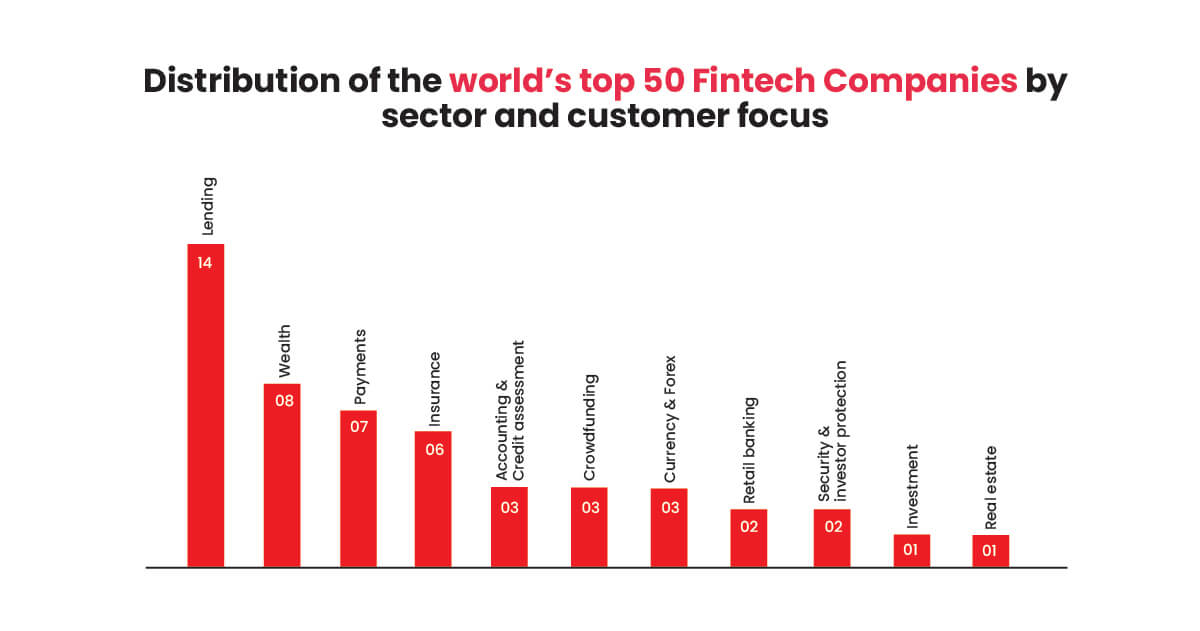

As the financial requirements of Americans change, so does the demand for creative financial service company models. The following list of the most prominent FinTech business models may provide some guidance to investors and entrepreneurs as they attempt to synthesize breakthrough concepts.

1. Digital Banking

According to Statista, there will be 290 million smartphone users in the US in August 2021. In another report by the FDIC Survey of Household Use of Banking and Financial Services study, 124 million American households had bank accounts as of 2019. (representing 95% of the US population.)Banks and smartphones are intended to be a terrific marriage, and firms that capitalize on their potential may do well in the FinTech market.

This business model includes web-based services and a high level of automation, which may involve the creation and integration of APIs that enable cross-institutional service delivery for banking services and financial transactions.

Related: How FinTech Startups Are Making Life Easier

Users may now access financial data, initiate money transfers through mobile, smartphone, desktop, and ATM devices, and make debit card payments using this FinTech business model.

It is reasonable to assume that digital banks enjoy widespread customer approval. However, more than 31% of the population does not have a bank account. With a digital bank, you can simply promote to individuals who are already familiar with internet banking as well as the unbanked.

Incorporate blockchain technology into your product to help you establish a more secure ecosystem for your customer base, providing you with a competitive advantage over rival financial institutions.

The Pros and Cons of the Digital Banking Business Model

Pros:

- Consumers in most places in the world may readily utilize a digital payment method.

- Most digital banks provide higher rates and cheaper transaction costs to customers.

- Both the unbanked and banked communities benefit from digital wallets.

Cons:

- Because the bank is entirely online, there may be some downtime.

- It is difficult to acquire sufficient funding without the support of a venture capitalist or another type of investor.

2. Alternative Credit Score

An alternative credit score is a FinTech innovation that assists borrowers in determining the creditworthiness of lenders by utilizing relevant, current, and easily accessible data such as their digital footprint.

This business model is beneficial for FinTech businesses that want to provide loans to people who are not well captured by the traditional credit score system. For example, small business proprietors.

As a startup, you may request a variety of alternative data and synchronize the results with certain standard records for a thorough credit evaluation. Many FinTech firms are already incorporating this FinTech business model into their financial products.

Owning a lending platform is one of the most profitable businesses in the world. However, for a significant profit, it’s advisable to use an alternative credit scoring algorithm because it allows you to reach a larger audience pool.

Alternative Credit Score: Pros and Cons

Pros:

- More borrowers may be eligible for the loan.

- It enables lenders to actively enhance their credit score valuation.

Cons:

- Personal information about lenders is shared with a FinTech business.

- The majority of government-backed traditional lending institutions are unaware of this business model.

3. Investment Management

Most customers find it difficult to make investments and manage their asset accounts. As a company, you may capitalize on this business model by developing a wealth management platform that allows investors to trade from anywhere.

Trades are completed through easy-to-use trading software, and signals are delivered to high-frequency traders who can affect asset prices. Investor positions are executed immediately, and asset liquidation is completed quickly.

There is no denying that this FinTech business model will see tremendous expansion in the next few years. Having an investment solution puts your company in an excellent position to capitalize on the upcoming demand. To be lucrative with this business model, your company may charge a commission for completed deals.

Pros and Cons of Investment Management Model

Pros:

- The process of investment execution and asset management has no boundaries.

- It attracts new investors.

Cons:

- Minimal personal finance counsel is required.

- Market manipulation is common in trading.

4. Small-Budget Loans

Banks and lenders frequently reject applications for small-ticket loans due to poor profits and the comparatively high expense of setting up and repaying those loans. However, some FinTech businesses use a business strategy that allows them to respond to the demands of this target market.

Some FinTech lending businesses have devised a successful impulse purchase mechanism strategy. This is a one-click buy now button that is placed on e-commerce websites to allow users to make rapid purchases using consumer loans without having to enter their credit card information or go through any type of authentication.

Related: These popular NLP applications are changing the face of Finance

These loans are frequently underwritten at 0% interest, and borrowers have the option of making payments in periodic installments. As a startup interested in this business model, you may profit by requesting interest on your loans or exchanging consumer data with original equipment manufacturers.

This method, like the others listed above, allows you to target a market that most traditional lenders avoid. This company’s operating model is simple to implement because your FinTech startup will provide important customer data. At the same time, customers have easy access to low-cost loans.

Small Ticket Loans: Pros and Cons

Pros:

- It helps in targeting customers at the moment of purchase.

- It gives actionable and significant value to your end consumers.

Cons:

- Consumer information is shared with corporations.

- High delinquency rate

5. Alternative Insurance Underwriting

The total cost of health insurance policies purchased by 179 million Americans (55 percent of the US population) in 2019 was $1,195 billion.This demonstrates that a huge portion of the American population, from company owners to 9-5 employees, still relies on insurance as a safety net for unexpected situations.

Traditional insurance underwriting bases insurance rates on a set of quantitative parameters. However, those components are sometimes referred to as inadequate since they do not include non-quantifiable but crucial aspects such as exercise.

For example, two people of the same weight and height who do not drink alcohol and do not smoke will most likely receive the same insurance policy amount. However, one may be a fitness fanatic, whilst the other may spend the majority of his day on the sofa, increasing his risk of diabetes.

Alternative insurance underwriting gathers both measurable and unquantifiable variables such as medical history, lifestyle, and social signals to assist in capturing an intended policyholder’s risk more effectively.

When combined with self-learning and sophisticated algorithms, insurtech startups and insurance firms now have a smarter approach to identifying policyholders, giving better terms and conditions, and providing alternative payment choices.

As a startup with a predisposition for rapid expansion, it’s critical to establish a business model that accurately depicts your company’s development plan. Using this operating model ensures that you will properly assess all possibilities and provide policyholders with the premium that they deserve.

This results in an excellent user experience and a high client retention rate. Customers will receive premiums that they believe they deserve.

Alternative Insurance Underwriting: Pros and Cons

Pros:

- Everyone has easy access to it.

- Customers believe it is more equitable.

Cons:

- Insurance premiums are frequently low.

- A single method cannot be applied to all forms of insurance.

Payment Gateways

Payment gateways are required for any online transactions, whether they be for eCommerce, meal ordering, or other product or service websites.

However, setting up and maintaining these payment gateways is expensive for businesses. Because this cost goes to banks, developers, and a variety of other resources, payment gateways are an expensive transaction alternative.

Fortunately, this problem may be overcome by including these transactions in apps that internet retailers can afford. Ideally, these apps’ user bases will comprise enterprises that offer their products or services through their websites.

The Advantages of the FinTech Business Model

- Financially Beneficial

Because the financial industry is one of the world’s largest groups of sectors, there are several chances to generate huge quantities of money. Startups in the financial services industry are among the best-funded and most valued.

- Loyal Customer Base and Retention

The average American adult has had a bank account for 16 years. Customers rely on their banks to safeguard their assets, lend money for life-changing purchases like a home, and advise them on how to handle their current wealth wisely. While acquiring a client isn’t cheap (banks, for example, spend billions of dollars each year on various marketing campaigns), they tend to remain extremely loyal throughout their membership.

- Democratization of the Economy

The introduction to business has always been inappropriate. Whether it’s autonomous trade or present class perfections, not everyone had the option to engage in the economy or obtain access to comparable economic prospects in the past. However, technological advancements have enabled the democratization of financial services.

For example, the benefits of automation not only save costs but also provide easy-to-use tools to the public. Previously, only individuals at the top of the pyramid could be economically democratized from a business standpoint, but today individuals at the bottom may be as well.

- Delayed Incumbent

Many incumbent players (especially conventional banks) rely on out-of-date technology. This makes responding to constantly changing consumer patterns extremely difficult. Some newly established neobanks have taken advantage of this delayed incumbent and begun to siphon clients from existing banks. Other incumbents have reacted by creating strategic agreements with these challenger banks, giving banking licenses and regulatory knowledge in exchange.

The Disadvantages Of The FinTech Business Model

- Highly Regulated Industry

There are over 20 governmental institutions in the US alone that oversee a bank’s compliance with existing regulations. Furthermore, existing laws as well as accounting standards are changed continuously. Complying with all of these regulations can therefore be extremely complex.

- High Operational Costs

A complicated regulatory body necessitates the hiring of trained workers capable of navigating this environment. Furthermore, because the financial sector is so profitable, FinTech companies must frequently engage in client acquisition.

How Do FinTech Startups Make Their Money?

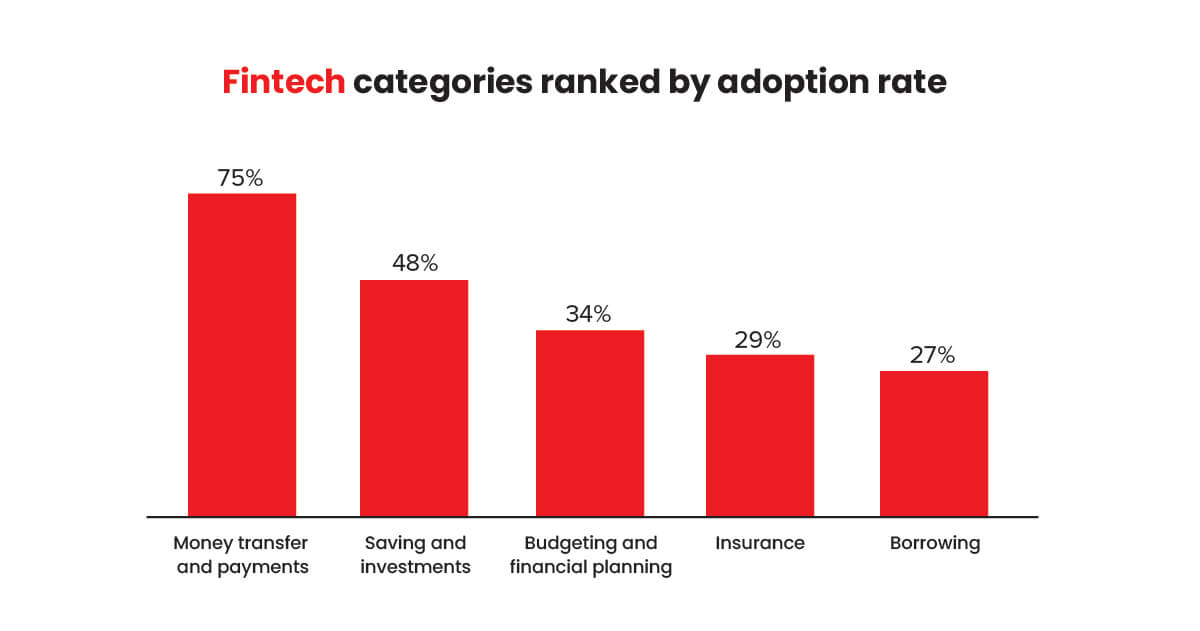

FinTech firms are typically more concerned with growth than with profit. However, they eventually search for new methods to make more money. How? Using the FinTech model outlined above, let us emphasize the primary sources of their income:

- Budgeting and Financial Management: services that offer management of income and expenditures.

- Crowdfunding: a collection aimed at providing monetary contributions for projects or financial institutions.

- Blockchain and Cryptocurrencies: using a decentralized system.

- Lending: peer-to-peer lending platforms.

- Robo-advising: charging a certain percentage of total assets.

- Fees and Subscriptions: the money comes from the consumers.

- Third parties: accounting services, credit scoring tools, health insurance.

- Advertising: product owners sell the attention or data of their customers to advertising and business partners.

- Data Transmission: gathering data and offering a more personalized service to users.

- APIs as a source of revenue: selling licenses and code.

A revenue model is based on aspects such as who pays, what payment structure is used, and how it affects the customer. The primary issue for FinTechs is to keep the firm profitable while adhering to the company’s goal and vision.

Final Thoughts

Though FinTech is not a new idea, it has only evolved at a fairly quick rate in the last few years. Several firms and investors throughout the world profit from the FinTech approach. It is supporting them in receiving financial awards and taking advantage of various chances.

In this post, we covered the most prominent FinTech business models that have performed admirably since their introduction, as well as the advantages and disadvantages of each model. The incorporation of new business models into the traditional banking environment has the potential to assist the banking and financial services industry in meeting international requirements.

How Day One Can Help FinTech Startups and Enterprises

With Day One, you can use our developers to create a new web or mobile application for your FinTech company, modernize your existing FinTech app, obtain a complex FinTech solution, or expand your technical staff.

- FinTech web and mobile development

- FinTech solutions based on artificial intelligence and machine learning

- Online trading and exchange platform engineering

- Open banking and credit reference agency integration

- Payment systems integration and optimization

- Money transaction platform engineering

Day One is ready to assist you regardless of your FinTech business model, as we have mastered the newest financial technology and gained expertise in producing reliable, robust, secure, and sophisticated FinTech solutions and products. We are well-versed in FinTech trends, innovations, and new business models; we are always learning, attending the finest FinTech conferences, and have the most skilled team of web and mobile developers.

You may also be confident that by teaming up with Day One, you are partnering with developers who are familiar with FinTech development standards and constraints.

Let’s talk about your FinTech opportunities!

Testimonials What customers have to talk about us

Finch (previously Trio) – Growth with Investing, with benefits of Checking

Reading Time: < 1 minThe Finch (previously Trio), one of our clients today has reached this level with our expertise and with a great team of developers in Day One, who have made every stone unturned in making this project a big success.

Neel Ganu Founder

USA

Vere360 – VR based Immersive Learning

Reading Time: < 1 minDay One helped Vere360 “fill skill gaps” and build a platform that would cater to their niche and diverse audience while seamlessly integrate the best of #AI and #VR technology.

Ms. Adila Sayyed Co-Founder

Singapore

1TAM – Video Blogging Reimagined

Reading Time: < 1 min‘1TAM’ was only for iOS with gesture-based controls, advanced video compression techniques, and a simple architecture that allowed actions to be completed in 2-3 taps. The real challenge for ‘1TAM’ was to keep it distinct which bought brilliant results with all the strategies and approaches implied for best video compression techniques.

Anwar Nusseibeh Founder

UAE

Fit For Work – The Science of Workplace Ergonomics

Reading Time: < 1 minDay One Technologies came with the expertise that was required and helped in building a platform that is edgy, functional, and smart, delivering engagement and conversions at every step.

Ms. Georgina Hannigan Founder

Singapore

SOS Method Meditation for ‘Busy Minds’

Reading Time: < 1 minDay One Technologies helped in building an innovative mobile app (for #iOS and #Android) that’s easy-to-use, engaging, and data-driven to help users reap the most at every point.